Checking Accounts

Find the account option that makes your everyday banking easier.

Our checking account options are designed to help you make the most of the money you’re already spending. Choose an account that fits your lifestyle by comparing discounts and protection benefits.

Checking Account Features

Premier Checking

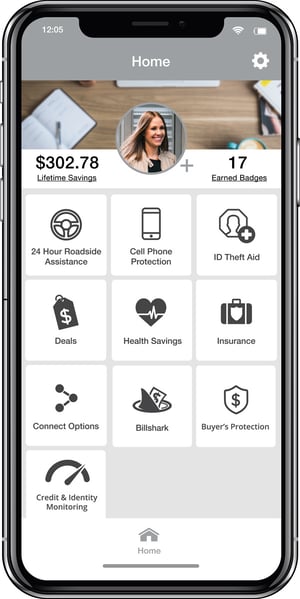

Our most popular account with no minimum balance requirement and access to the following Red Canoe Perks:

- Cell phone coverage

- Roadside assistance

- ID theft protection

- Discount on loan rates

- Travel and shopping discounts

Simply Smart Checking

A basic checking account for your everyday needs.

- No minimum balance requirement

- Anywhere banking tools

Premier Checking

Our most popular account with no minimum balance requirement and access to the following Red Canoe Perks:

- Cell phone coverage

- Roadside assistance

- ID theft protection

- Discount on loan rates

- Travel and shopping discounts

Premier Plus Checking

This VIP plan comes with all of the Red Canoe Perks of Premier Checking, plus:

- Credit score monitoring

- Higher certificate account rates

- Increased coverage limits

Premier Checking

Our most popular account with no minimum balance requirement and access to the following Red Canoe Perks:

- Cell phone coverage

- Roadside assistance

- ID theft protection

- Discount on loan rates

- Travel and shopping discounts

Simply Smart Checking

A basic checking account for your everyday needs.

- No minimum balance requirement

- Anywhere banking tools

Premier Checking

Our most popular account with no minimum balance requirement and access to the following Red Canoe Perks:

- Cell phone coverage

- Roadside assistance

- ID theft protection

- Discount on loan rates

- Travel and shopping discounts

Premier Plus Checking

This VIP plan comes with all of the Red Canoe Perks of Premier Checking, plus:

- Credit monitoring

- Higher certificate account rates

- Increased coverage limits

Compare All Checking Account Perks

| Benefit | Simply Smart Checking | Premier Checking* | Premier Plus Checking* | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Benefit | Anywhere Banking ToolsOnline and Mobile Banking, Bill Pay and Debit Card Round Up |

Simply Smart Checking | Premier Checking* | Premier Plus Checking* | ||||||||||||||||||||||||

| Benefit | No Minimum Balance RequiredEnjoy the freedom of our checking accounts with no minimum balance required. |

Simply Smart Checking | Premier Checking* | Premier Plus Checking* | ||||||||||||||||||||||||

| Benefit | Shop Local, Save LocalLocal and national discounts to save you money on shopping, dining, travel, and more. |

Simply Smart Checking | – |

Premier Checking* | Premier Plus Checking* | |||||||||||||||||||||||

| Benefit | Health Savings CardSave money on prescriptions, eye exams, frames, lenses and hearing services. |

Simply Smart Checking | – |

Premier Checking* | Premier Plus Checking* | |||||||||||||||||||||||

| Benefit | Cell Phone ProtectionYou're covered when you pay your phone bill with your Premier or Premier Plus account. |

Simply Smart Checking | – |

Premier Checking* | $400/claim |

Premier Plus Checking* | $600/claim |

|||||||||||||||||||||

| Benefit | Roadside AssistanceAvailable 24/7 and free to use, up to $80 in covered service charges. |

Simply Smart Checking | – |

Premier Checking* | Premier Plus Checking* | |||||||||||||||||||||||

| Benefit | Accidental Death CoveragePeace of mind for the unexpected. |

Simply Smart Checking | – |

Premier Checking* | $10,000 |

Premier Plus Checking* | $25,000 |

|||||||||||||||||||||

| Benefit | ID Theft AidGet reimbursed for select expenses, card fraud resolution, and identity restoration if your ID is compromised. Activation required. |

Simply Smart Checking | – |

Premier Checking* | $5,000 |

Premier Plus Checking* | $10,000 |

|||||||||||||||||||||

| Benefit | Buyer's Protection Extended WarrantyItems purchased with your Premier or Premier Plus account are protected for up to $2,500 per item. Restrictions apply. |

Simply Smart Checking | – |

Premier Checking* | Premier Plus Checking* | |||||||||||||||||||||||

| Benefit | BillsharkBillshark can negotiate select bills on your behalf, or cancel unwanted subscriptions. Activation is required. |

Simply Smart Checking | – |

Premier Checking* | Premier Plus Checking* | |||||||||||||||||||||||

| Benefit | 0.25% Consumer Loan DiscountValid on new consumer collateralized loans. Some restrictions apply. |

Simply Smart Checking | – |

Premier Checking* | Premier Plus Checking* | |||||||||||||||||||||||

| Benefit | 0.25% APY Certificate Rate BumpValid on new certificate accounts. APY=Annual Percentage Yield. |

Simply Smart Checking | – |

Premier Checking* | – |

Premier Plus Checking* | ||||||||||||||||||||||

| Benefit | Credit MonitoringSee your credit score in the Perks app, updated quarterly! Your credit report will be monitored regularly. Activation is required. |

Simply Smart Checking | – |

Premier Checking* | – |

Premier Plus Checking* | ||||||||||||||||||||||

| Benefit | Monthly Fee |

Simply Smart Checking | $5 or waived with eStatements** |

Premier Checking* | $7 |

Premier Plus Checking* | $10 |

|||||||||||||||||||||

| Simply Smart Checking | Anywhere Banking ToolsOnline and Mobile Banking, Bill Pay and Debit Card Round Up |

No Minimum Balance RequiredEnjoy the freedom of our checking accounts with no minimum balance required. |

Shop Local, Save LocalLocal and national discounts to save you money on shopping, dining, travel, and more. |

– |

Health Savings CardSave money on prescriptions, eye exams, frames, lenses and hearing services. |

– |

Cell Phone ProtectionYou're covered when you pay your phone bill with your Premier or Premier Plus account. |

– |

Roadside AssistanceAvailable 24/7 and free to use, up to $80 in covered service charges. |

– |

Accidental Death CoveragePeace of mind for the unexpected. |

– |

ID Theft AidGet reimbursed for select expenses, card fraud resolution, and identity restoration if your ID is compromised. Activation required. |

– |

Buyer's Protection Extended WarrantyItems purchased with your Premier or Premier Plus account are protected for up to $2,500 per item. Restrictions apply. |

– |

BillsharkBillshark can negotiate select bills on your behalf, or cancel unwanted subscriptions. Activation is required. |

– |

0.25% Consumer Loan DiscountValid on new consumer collateralized loans. Some restrictions apply. |

– |

0.25% APY Certificate Rate BumpValid on new certificate accounts. APY=Annual Percentage Yield. |

– |

Credit MonitoringSee your credit score in the Perks app, updated quarterly! Your credit report will be monitored regularly. Activation is required. |

– |

Monthly Fee |

$5 or waived with eStatements** |

||

| Premier Checking* | Anywhere Banking ToolsOnline and Mobile Banking, Bill Pay and Debit Card Round Up |

No Minimum Balance RequiredEnjoy the freedom of our checking accounts with no minimum balance required. |

Shop Local, Save LocalLocal and national discounts to save you money on shopping, dining, travel, and more. |

Health Savings CardSave money on prescriptions, eye exams, frames, lenses and hearing services. |

Cell Phone ProtectionYou're covered when you pay your phone bill with your Premier or Premier Plus account. |

$400/claim |

Roadside AssistanceAvailable 24/7 and free to use, up to $80 in covered service charges. |

Accidental Death CoveragePeace of mind for the unexpected. |

$10,000 |

ID Theft AidGet reimbursed for select expenses, card fraud resolution, and identity restoration if your ID is compromised. Activation required. |

$5,000 |

Buyer's Protection Extended WarrantyItems purchased with your Premier or Premier Plus account are protected for up to $2,500 per item. Restrictions apply. |

BillsharkBillshark can negotiate select bills on your behalf, or cancel unwanted subscriptions. Activation is required. |

0.25% Consumer Loan DiscountValid on new consumer collateralized loans. Some restrictions apply. |

0.25% APY Certificate Rate BumpValid on new certificate accounts. APY=Annual Percentage Yield. |

– |

Credit MonitoringSee your credit score in the Perks app, updated quarterly! Your credit report will be monitored regularly. Activation is required. |

– |

Monthly Fee |

$7 |

||||||||

| Premier Plus Checking* | Anywhere Banking ToolsOnline and Mobile Banking, Bill Pay and Debit Card Round Up |

No Minimum Balance RequiredEnjoy the freedom of our checking accounts with no minimum balance required. |

Shop Local, Save LocalLocal and national discounts to save you money on shopping, dining, travel, and more. |

Health Savings CardSave money on prescriptions, eye exams, frames, lenses and hearing services. |

Cell Phone ProtectionYou're covered when you pay your phone bill with your Premier or Premier Plus account. |

$600/claim |

Roadside AssistanceAvailable 24/7 and free to use, up to $80 in covered service charges. |

Accidental Death CoveragePeace of mind for the unexpected. |

$25,000 |

ID Theft AidGet reimbursed for select expenses, card fraud resolution, and identity restoration if your ID is compromised. Activation required. |

$10,000 |

Buyer's Protection Extended WarrantyItems purchased with your Premier or Premier Plus account are protected for up to $2,500 per item. Restrictions apply. |

BillsharkBillshark can negotiate select bills on your behalf, or cancel unwanted subscriptions. Activation is required. |

0.25% Consumer Loan DiscountValid on new consumer collateralized loans. Some restrictions apply. |

0.25% APY Certificate Rate BumpValid on new certificate accounts. APY=Annual Percentage Yield. |

Credit MonitoringSee your credit score in the Perks app, updated quarterly! Your credit report will be monitored regularly. Activation is required. |

Monthly Fee |

$10 |

Disclosures

*Premier, Premier Plus and the Red Canoe Perks app are powered by BaZing. Find BaZing disclosures in the benefits guide you receive at account opening.

Get your Red Canoe Perks

Take advantage of Red Canoe Perks with a Premier or Premier Plus checking acccount. Powered by the BaZing network, the Perks app is how you'll access the discounts and coverage that come with your account.

- Click on your app store below and download the app.

- Using the email and temporary password you received in your email at account opening, login.

- Follow the prompts on-screen to complete your enrollment.

Open a Checking Account

Select

Choose between Simply Smart, Premier, or Premier Plus Checking

Apply

Complete the application and provide a copy of your ID. It only takes 5 minutes.

Fund

Fund your account with at least $5 and confirm your information.

Select

Choose between Simply Smart, Premier, or Premier Plus Checking.

Apply

Complete the application and provide a copy of your ID. It only takes 5 minutes.

Fund

Fund your account with at least $5 and confirm your information.

Overdraft Programs

Peace of mind for your checking account.

When your account overdrafts, and you don’t have the funds to cover your purchases or automatic payments, there are several options for what can happen next. Click below to learn what options you have for overdraft protection.

A Branch or ATM Around Each Bend

11 branches spread across Washington and Oregon, plus 30,000+ surcharge-free ATMs.

Member, owner, neighbor – you’re a local and so are we.

Visit your nearest branch and use your debit card at a surcharge-free ATM for easy access and five-star service.